Your SOLUTION for Modern Deposit Growth

Grow Deposits Securely Online

Turn your digital presence into a deposit magnet. Attract, convert, and retain deposits with modern tools that are already working in the market.We combine proven technology, deep experience, and a tested playbook to help you attract and retain retail deposits in a secure and scalable way.

600% Increase

Initial Funding

2x

Avg. Initial Balance

<3 Minutes

Avg. Opening Duration

capture deposits. BE EFFICIENT. GROW AND SAVE MONEY.

The Only End-to-End Solution for Deposit Growth

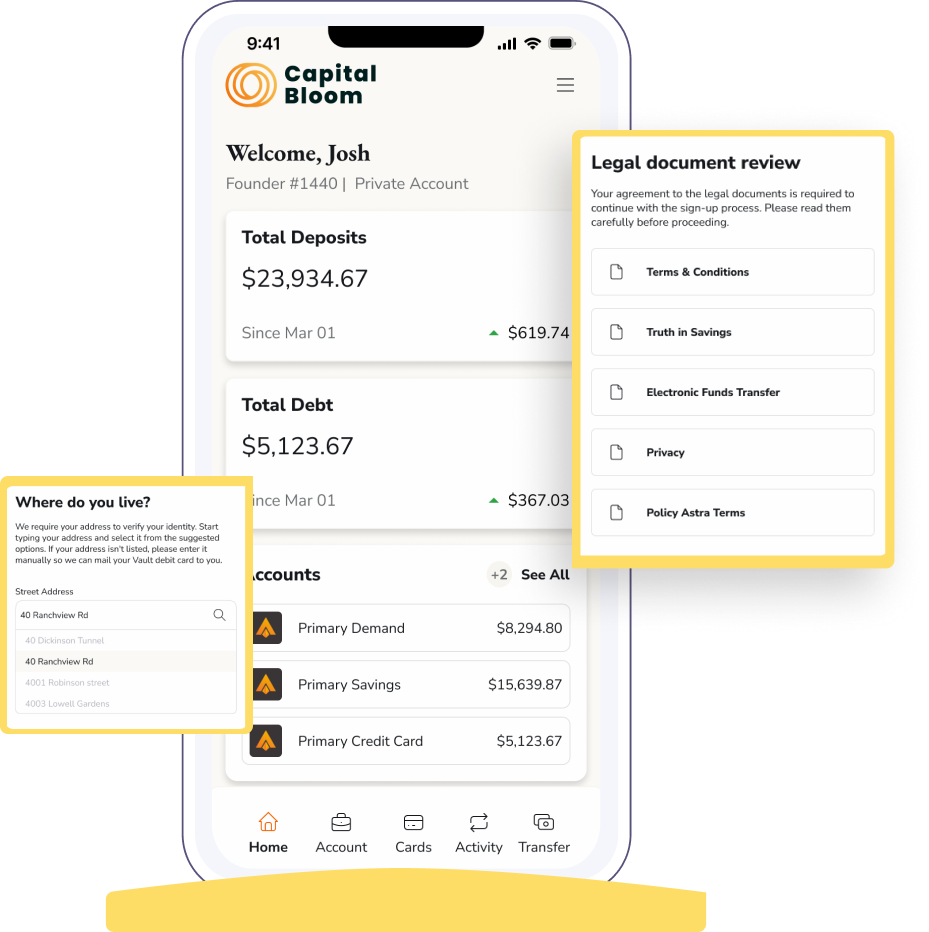

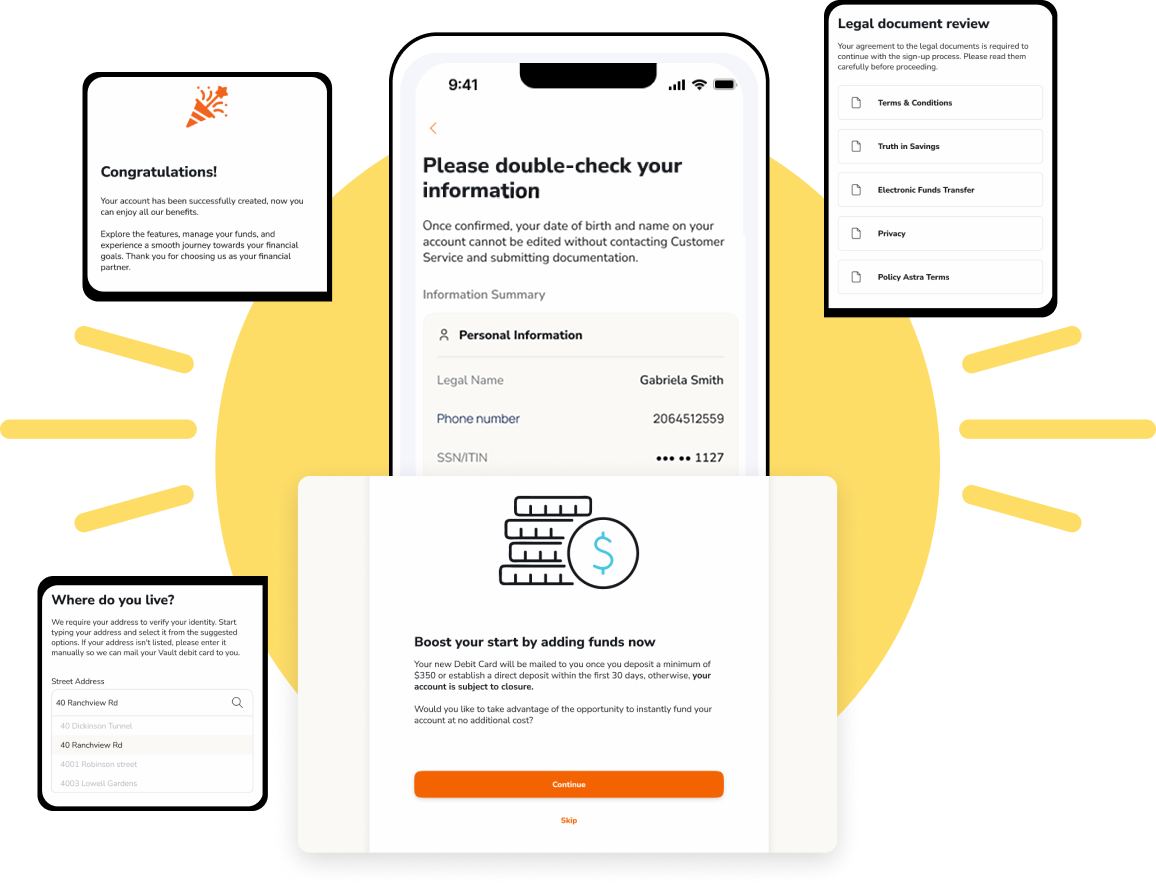

From Data collection to Account Funding

Gather information, verify identity (KYC), present disclosures, e-sign, collect funding, and assist with product selection. Then, automatically create accounts in your core and digital banking platform.

Reminders and follow-ups are built in, so nothing slips through the cracks.

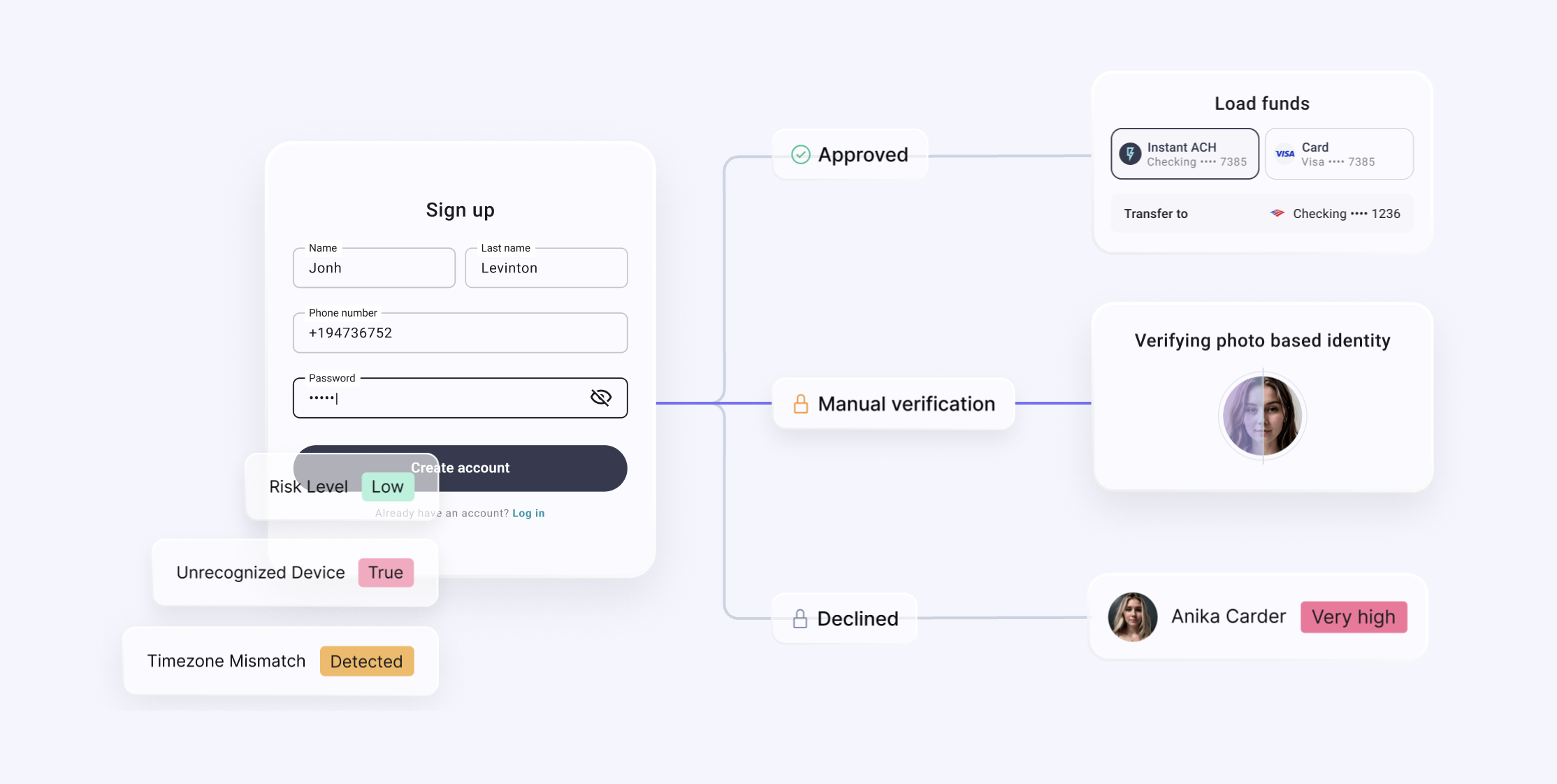

Best-in-Class Fraud Detection, Built In

We partner with industry leaders like Sardine, Incode, and Alloy to verify identity and stop fraud before it starts.

Bots, ring networks, and synthetic identities are blocked in real time with MFA, device intelligence, and behavior analytics, all without slowing down trusted customers.

Every application, in one place

Linker includes a built-in CRM and dashboard so your team can review applications, freeze or close accounts, and track opportunities across the lifecycle.

See the full customer picture across business and retail in a single view.

If you already use a CRM, we can integrate with it.

Why Linker Finance?

Efficient Auto-decisioning with Step-up KYC

Industry Leading Fraud Detection & Prevention

Instant Originated Funding at Onboarding

Real-time, two-way integration to the Core

Programable funding and engagement reminders

CRM with Analytics of your Customers and Opportunities

The Best TCO and ROI while simplifying your stack

No extra Vendors

Work with your existing vendors, or choose from trusted partners we’ve vetted for performance, security, and reliability.

Linker fits into your current systems, without adding complexity.

Linker is already integrated with your Core and live on the Fiserv AppMarket.

Member of